Terrific Suggestions Regarding House Mortgages That Any Person Can Quickly Adhere To

Article writer-Connor HoffmanAre you a mortgage loan veteran? The market for mortgages is always in flux, and it can be hard to keep track of all of these changes. If you want to get the best terms on your mortgage, understanding all the changes is essential. Continue reading to gain some valuable information.

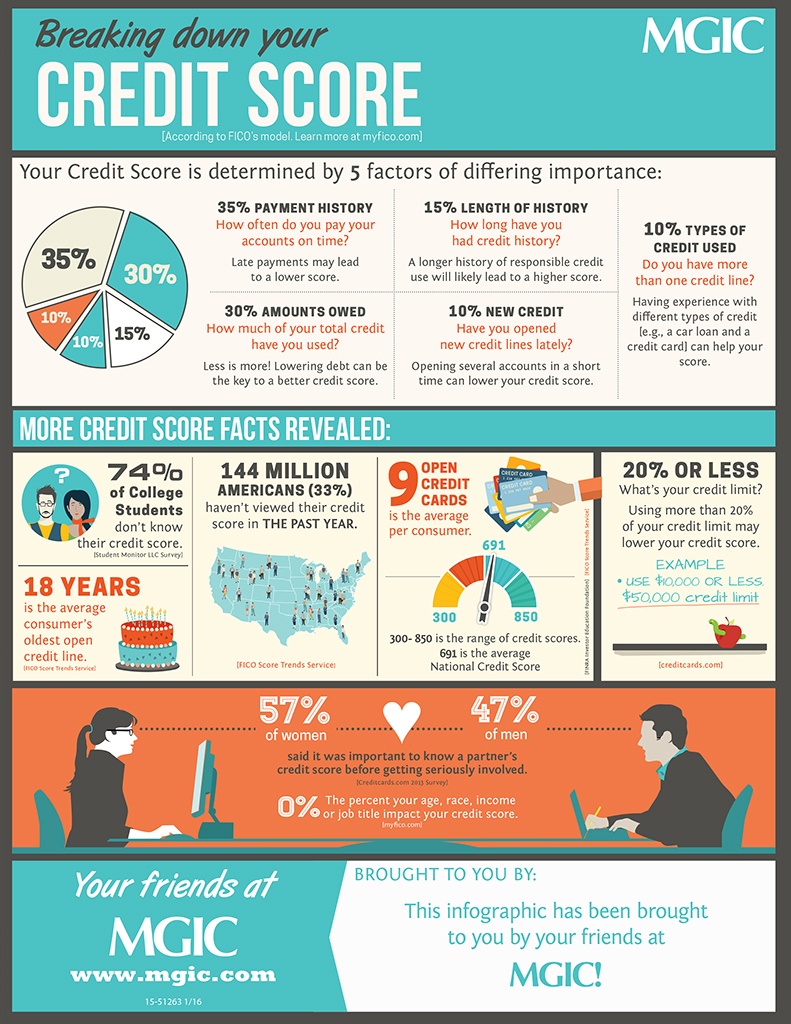

Before trying to get a mortgage approval, find out your credit score. Mortgage lenders can deny a loan when the borrower has a low credit score caused by late payments and other negative credit history. If your credit score is too low to qualify for a mortgage loan, clean up your credit, fix any inaccuracies and make all your payments on time.

Before you start looking for home mortgages, check your credit report to make sure that there are no errors or mistakes. Securing a loan was not always as hard as it is now, so you need to make sure that you have a good credit rating and the least amount of debt possible to get the best home loan.

Think about getting a consultant hired if you wish to get help with your home mortgage. There is much to learn in this process, and they can help you obtain the best deal you can. They can also make sure your have fair terms instead of ones just chosen by the company.

Try shopping around for a home mortgage. When you do shop around, you need to do more than just compare interest rates. While they're important, you need to consider closing costs, points and the different types of loans. Try getting estimates from a few banks and mortgage brokers before deciding the best combination for your situation.

You should know that some mortgage providers sometimes approve clients for loans they cannot really afford. It is up to you to make sure you will be able to make the payments on time over the next years. It is sometimes best to choose a smaller mortgage even though your mortgage provider is being generous.

Obtain a credit report. It is important to understand your credit rating before you begin any financial undertaking. Order reports from all 3 of the major credit reporting agencies. Compare them and look for any erroneous information that may appear. Once you have a good understanding of your ratings, you will know what to expect from lenders .

Get quotes from many refinancing sources, before signing on the dotted line for a new mortgage. While rates are generally consistent, lenders are often open to negotiations, and you can get a better deal by going with one over another. Shop around and tell each of them what your best offer is, as one may top them all to get your business.

Check with your local Better Business Bureau before giving personal information to any lender. Unfortunately, there are predatory lenders out there that are only out to steal your identity. By checking with your BBB, you can ensure that you are only giving your information to a legitimate home mortgage lender.

Know your credit score and verify its accuracy. Identity theft is a common occurrence so go over your credit report carefully. Notify the agency of any inaccuracies immediately. Be particularly careful to verify the information regarding your credit limits. Make all your payments in a timely manner to improve your score.

Do not allow yourself to fall for whatever the banks tell you about getting a home mortgage. You have to remember that they are in the business of making money, and many of them are willing to use techniques to suck as much of that money out of you that they can.

Before https://www.bankrate.com/banking/what-is-a-digital-wallet/ apply for a mortgage, make sure you have a substantial savings account. You are going to need money to cover the down payment, closing costs and other things like the inspection, fees for applications and appraisals. Naturally, the larger your down payment, the better terms you will get on your home mortgage.

Do not pay off all of your old bills until you have talked to a mortgage consultant. If your bills will not have a negative impact on your ability to get a loan, you can worry about paying them later. You don't want to spend lots of money to pay them since this can affect the amount of available income you have.

Pay your mortgage down faster to free up money for the future. Pay a little extra each month when you have some extra savings. When you pay the extra each month, make sure to let the bank know the over-payment is for the principal. You do not want them to put it towards the interest.

Some consumers may benefit from a mortgage loan where payments are made every two weeks instead of once a month. By doing this you are doubling the amount of payments you make, and that lessens greatly the amount of interest you will pay back over the course of the loan. If your payday comes every two weeks, this is great since the payment will just be taken out of your account automatically.

Make sure that you fully understand the process of a mortgage. You need to stay informed throughout the process. Give all contact information to your broker. Keep up with emails and other messages from the brokerage firm, in case they need to update your files with additional information.

Be sure to get home insurance quotes before you sign a home mortgage contract. There are many factors that could lead to a very high insurance rate. You want to be sure that you can afford everything involved before you get yourself locked into a contract that could lead to financial disaster in the end.

Save some money before applying for a mortgage. Required down payments vary, but you probably want to have no less than 3.5% available. The higher it is, the better it may be for you. If you take a private mortgage, you'll need to pay extra if you put less than 20 percent down.

Realizing that you have just bought a home and have a good mortgage is a great feeling. This is a loan that you're going to carry for years, and you want it to be both affordable and accommodating. So, use the information that has been passed on to you so that you can find a good mortgage.